Amazon financial analysis 2019 images are ready. Amazon financial analysis 2019 are a topic that is being searched for and liked by netizens now. You can Find and Download the Amazon financial analysis 2019 files here. Get all royalty-free images.

If you’re looking for amazon financial analysis 2019 pictures information connected with to the amazon financial analysis 2019 interest, you have come to the ideal site. Our website frequently gives you hints for seeing the highest quality video and picture content, please kindly search and find more informative video articles and graphics that match your interests.

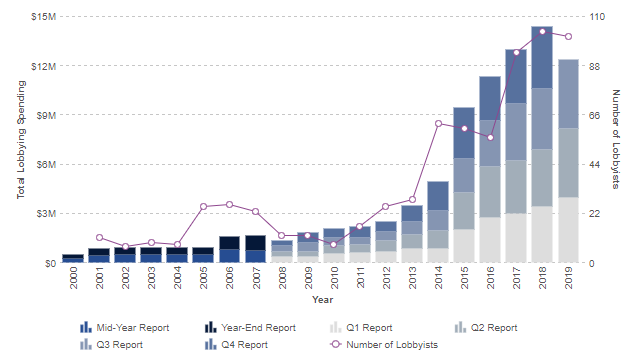

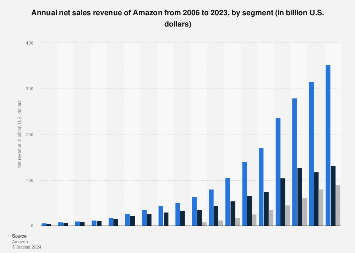

According to the companys annual report Amazons yearly sales growth rate was 21 in 2019. Fiscal year is January-December. This number changed because their current assets in 2017 were 60197000 and went up to 96334000 in 2019. Net sales are expected to be between 750 billion and 810 billion or to grow between 18 and 28 compared with second quarter 2019. The year prior it was 33.

Amazon Financial Analysis 2019. Amazon Financial Statement Analysis 1. Income before income taxes Amount of income loss from continuing operations including income loss from equity method investments before deduction of income tax expense benefit and income loss attributable to noncontrolling interest. 2020 2019 2018 2017 2016 5-year trend. Amazon from 2016 to 2019 has a.

Amazon Pestel Analysis Research Methodology From research-methodology.net

Amazon Pestel Analysis Research Methodology From research-methodology.net

Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN. Amazon from 2016 to 2019 has a. 2020 2019 2018 2017 2016 5-year trend. For that reason in comparison with all businesses the Company has a lower result. 2019 Not as Bright Amazons worldwide net sales in 2018 increased 31 percent to 2329 billion compared with 1779 billion in 2017. Ten years of annual and quarterly financial statements and annual report data for Amazon AMZN.

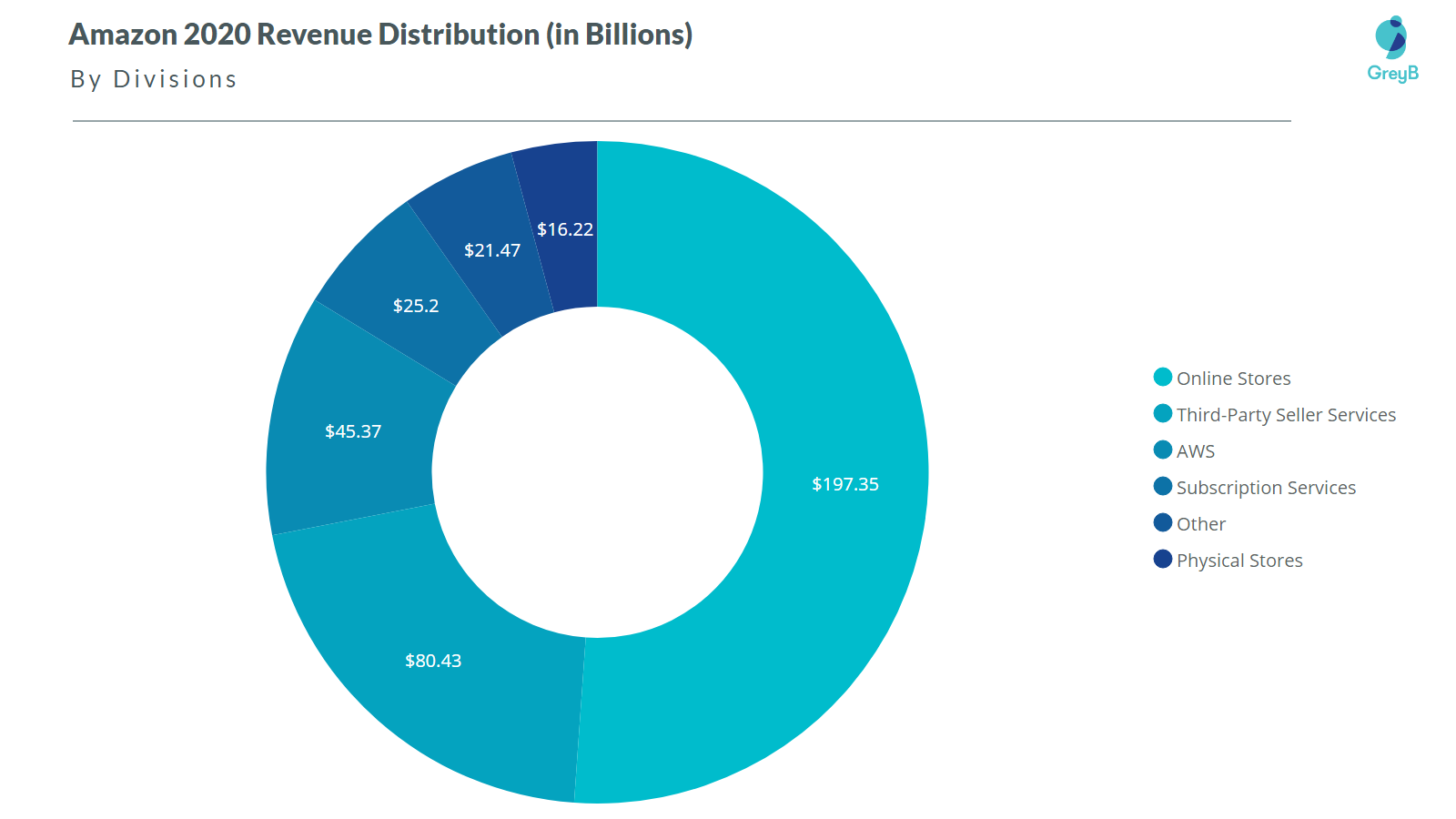

Despite the pandemic analysts estimate Amazons revenue will rise 243 for all of FY 2020.

Net sales are expected to be between 750 billion and 810 billion or to grow between 18 and 28 compared with second quarter 2019. Amazon Posts Stellar 2018 Financial Results. Joshua Scott Neeper April 18 2017 2. Find out the revenue expenses and profit or loss over the last fiscal year. This guidance anticipates an unfavorable impact of approximately 70 basis points from foreign exchange rates. In the first quarter of 2019 AWS revenue represented 13 of total sales for Amazon up from 10 from the previous quarter.

Source: greyb.com

Source: greyb.com

In 2019 is better than the financial condition of half of all companies engaged in the activity Catalog and Mail-Order Houses The average ratios for this industry are below the average for all industries. Dow Jones a News Corp company. Joshua Scott Neeper April 18 2017 2. For that reason in comparison with all businesses the Company has a lower result. Fiscal year is January-December.

Source: investopedia.com

Source: investopedia.com

This guidance anticipates an unfavorable impact of approximately 70 basis points from foreign exchange rates. Amazon P a g e 0 FINANCIAL STATEMENT ANALYSIS Amazon Apple Alibaba FISV 5526. Annual reports proxies and shareholder letters. Find out the revenue expenses and profit or loss over the last fiscal year. Fiscal year is January-December.

Source: cnbc.com

Source: cnbc.com

Income statements balance sheets cash flow statements and key ratios. Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN. According to the companys annual report Amazons yearly sales growth rate was 21 in 2019. Also their current liabilities were fluctuating between 57883000 and. Net sales are expected to be between 750 billion and 810 billion or to grow between 18 and 28 compared with second quarter 2019.

Source: corporatefinanceinstitute.com

Source: corporatefinanceinstitute.com

Dow Jones a News Corp company. Net sales are expected to be between 750 billion and 810 billion or to grow between 18 and 28 compared with second quarter 2019. But even AWS which reported 41 revenue growth has seen its growth. Fiscal year is January-December. View the latest AMZN financial statements income statements and financial ratios.

Source: statista.com

Source: statista.com

Had current ratio of 1040 2018 it went up to 1098 and in 2019 it came slightly down to 1097. But even AWS which reported 41 revenue growth has seen its growth. For that reason in comparison with all businesses the Company has a lower result. In addition some financial ratios derived from these reports are. The year prior it was 33.

Source: marketingcharts.com

Source: marketingcharts.com

Income statements balance sheets cash flow statements and key ratios. Dec 2019 Mar 2020. But even AWS which reported 41 revenue growth has seen its growth. Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN. Also their current liabilities were fluctuating between 57883000 and.

Source: businessofapps.com

Source: businessofapps.com

Joshua Scott Neeper April 18 2017 2. View the latest AMZN financial statements income statements and financial ratios. Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN. View AMZN financial statements in full. PDF On Jul 5 2020 Mohamed Bader Al-Marzooqi and others published Financial Analysis of Amazon Find read and cite all the research you need on ResearchGate.

Source: forbes.com

Source: forbes.com

Despite the pandemic analysts estimate Amazons revenue will rise 243 for all of FY 2020. But even AWS which reported 41 revenue growth has seen its growth. PDF On Jul 5 2020 Mohamed Bader Al-Marzooqi and others published Financial Analysis of Amazon Find read and cite all the research you need on ResearchGate. This number changed because their current assets in 2017 were 60197000 and went up to 96334000 in 2019. Also their current liabilities were fluctuating between 57883000 and.

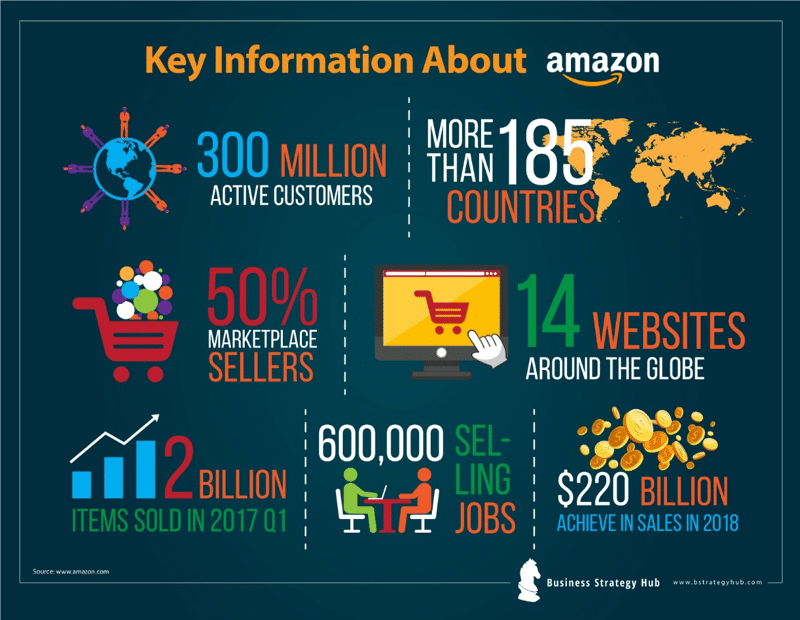

Source: bstrategyhub.com

Source: bstrategyhub.com

Ten years of annual and quarterly financial ratios and margins for analysis of Amazon AMZN. View AMZN financial statements in full. Income before income taxes Amount of income loss from continuing operations including income loss from equity method investments before deduction of income tax expense benefit and income loss attributable to noncontrolling interest. The outlook for 2019 however is not as positive. For that reason in comparison with all businesses the Company has a lower result.

Source: statista.com

Source: statista.com

Income before income taxes Amount of income loss from continuing operations including income loss from equity method investments before deduction of income tax expense benefit and income loss attributable to noncontrolling interest. Amazon Posts Stellar 2018 Financial Results. Income statements balance sheets cash flow statements and key ratios. This guidance anticipates an unfavorable impact of approximately 70 basis points from foreign exchange rates. Dow Jones a News Corp company.

Source: fourweekmba.com

Source: fourweekmba.com

But even AWS which reported 41 revenue growth has seen its growth. Amazon from 2016 to 2019 has a. The year prior it was 33. Had current ratio of 1040 2018 it went up to 1098 and in 2019 it came slightly down to 1097. Find out the revenue expenses and profit or loss over the last fiscal year.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site beneficial, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title amazon financial analysis 2019 by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.